Economic Headwinds And Crypto Blowup: Quarterly Review

If you’ve been enjoying my writing, I want to encourage you to subscribe to the notification list so that you never miss when I post a new blog! It may even prompt me to write more often :) And now to the new post!

Another quarter of a crazy 2022 is behind us, and it was not one to forget for the financial markets. Bitcoin has lost 60% from the start of the year, S&P 500 is down around 20%, and FTSE100 is down 2.4%. The Financial Times wrote on the 30th of June that US stocks suffered the most significant first-half decline in 50 years.

Although the same drivers which brought stock markets down played their role in the bitcoin downtrend, some unique factors exacerbated it.

There is much to unpack — from central banks raising rates across both sides of the Atlantic to one of the largest asset management firms embracing bitcoin. Let's dive straight in.

Rates Up, Markets Down

The markets' sell-off transpired from the action of the central banks to fight persistent inflation by raising interest rates and intensifying fears of major western economies falling into a recession. The Federal Reserve of the US and the Bank of England have already raised interest rates three and five times, respectively. And the European Central Bank is set to follow its counterparts with a 0.25% increase later in July.

Increasing interest rates is the central banks' favourite tool to tackle rising inflation by suppressing demand in economies. In the 1970s, the Fed jacked up rates to 20% to bring inflation down from double digits.

Nonetheless, inflation has not yet shown signs of slowing down. The annual inflation rate in the US hit 9.1% in June (a 0.7%month-on-month increase), while the UK's rate reached 9.4%, up from 9.1% in May. Rising interest rates and inflation is not a pleasant cocktail for risky assets like stocks and cryptocurrencies. Increasing inflation hurts businesses' profits as consumers buy fewer goods, while costs of production go up. Besides this, inflation usually means higher interest rates.

This Morningstar article explains the link between interest rates and stocks, but I've summarised the main effects of higher rates below.

rising rates slow down the economic growth hurting potential future profits for some companies

future companies’ profits are worth less today as discount rates rise

bonds become more attractive investments as they offer higher yields with lower risk

"But bitcoin is not an equity", one might say. As bitcoin adoption gains momentum, it attracts institutional investors who recognize bitcoin's diversification potential. However, these investors place bitcoin in their portfolio's riskier equity sleeve. When these investors sell equity during market downturns, they would also unload bitcoin.

We need to dig slightly deeper to understand the complete picture of the macroeconomic environment and what it means for bitcoin.

Inflation is a mere result of the supply-demand imbalance. After nearly a decade of stubbornly low inflation, the post-pandemic inflation surge has been driven by supply chain disruptions, lower production of goods and services and working from home. The latter gave people more money to spend and take full advantage of their Amazon Prime (I certainly did!)

Even though most problems lie on the supply side, as the supply chains were not designed for the whole world to shut down, central banks have the power to decrease the demand for goods and services, although with significant lags. By increasing interest rates, central banks can curb consumers spending their money as mortgages and credit card debts become more costly. Slowing down consumption is not ideal for western economies as they are primarily consumer-driven.

Some central banks, especially the Fed, have shown us over the past years that they have the power to stimulate the economy if they desire to do so. And yet, they can't fight inflation and stimulate the economy. By aggressively hacking interest rates over the past few months, the Fed has shown us which lever it is pulling.

In itself, tackling inflation with higher interest rates is an economic textbook practice — a central bank applies the breaks and slows down spending and price increases. However, when central banks are late to the party, the probability of them overreacting rises, leading to higher uncertainty and the likelihood of a hard landing — a severe recession.

US and Europe started noticing growing inflation back in the first quarter of 2021. And yet, central banks on both sides of the Atlantic kept interest rates at close to zero and continued quantitative easing (buying bonds and other securities from an open market) -- a practice they employed after the 2008 financial crisis to stimulate economic growth and inflation.

Throughout most of 2021, some central banks were firmly believing that the inflation would be transitory. They only realised how wrong they were towards the end of the year.

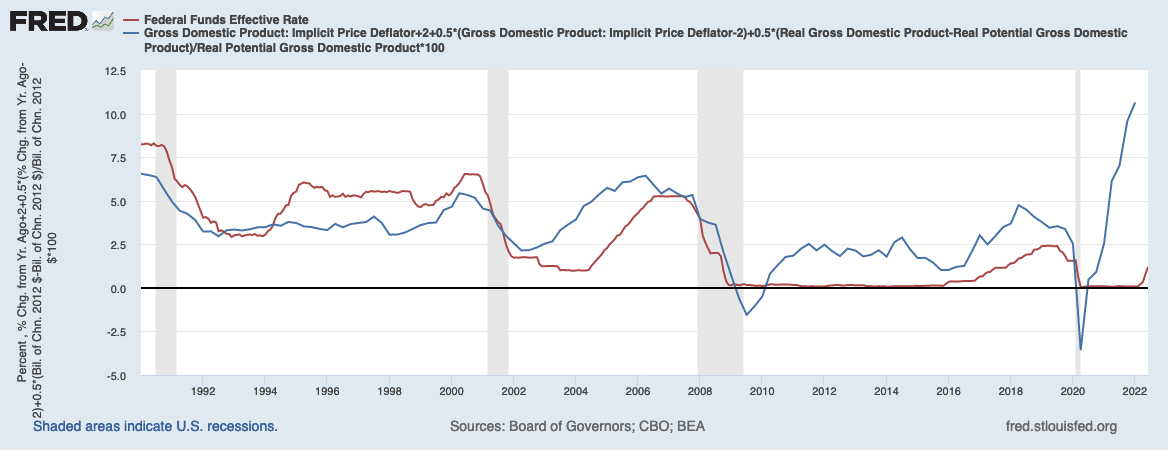

Central banks were late to the party, especially the Fed. The Taylor rule rate for the US economy, a benchmark used to determine the appropriate interest rate level given the economy's strength, rose sharply at the end of 2021. And yet, the Fed started increasing interest rates only in March of this year, when the US economy showed signs of slowing down.

Note: Blue line - Taylor Rule Rate; Red — Fed Fund Rates

Source: St Louis Fed (FRED)

Dominique Dwor-Frecaut, a senior macro strategist and Macro Hive, pointed out in an interview back in March that the slow actions by the Fed increased the risk of a hard landing for the US economy, forecasting a recession at the end of 2022 or 2023.

If we now step aside and think for a minute about what has caused the prices of goods and some services to spike — supply chain problems and shortage of commodities due to geopolitical events. Thus, the success of higher interest rates in bringing inflation down is doubtful because excessive consumers' enthusiasm to purchase new toys is not the only root cause of inflation.

Increasing interest rates by 25, 50 and even 75 basis points will not magically force the supply chains to function as intended, nor will it make more commodities available. On the contrary, higher rates make it more expensive for commodity companies to build new oil wells, gas pipelines or processing facilities. Thus, the textbook approach not only gives investors no confidence but causes for concerns that the Fed's actions could exacerbate things.

"Unfortunately, the Fed has no control over most of the current causes of inflation… Each of the causes of inflation needs its policy response. None will typically respond as predictably or quickly to aggressive tightening by the Fed," Rob Arnott and Campbell Harvey of Research Affiliates wrote in June.

What does the current macro environment mean for bitcoin? Firstly, as Vijay Boyapati pointed out in the second episode of Hard Money, the rising interest rate environment is unprecedented for bitcoin. Yet, the increasing interest rates climate makes it less attractive to place money into assets like gold or bitcoin, which have no yield. As mentioned before, bonds with higher yields and lower risk become the preferred destination for capital. Besides, companies and financial institutions that borrowed more to finance bitcoin or other assets become less reluctant to borrow more or even choose to sell these assets to cover their loans.

What can we expect from the Fed from now on? According to Morningstar, the Fed has room to increase interest rates further, as the US economic data shows a strong labour market and growth in gains.

However, there are limits on how long and much the Fed can tighten. In her May newsletter, Lyn Alden wrote that with the US's high debt/GDP ratio, higher interest rates increase the US Treasury's annual interest expense burden, making it hard for companies and individuals to refinance their debt.

In addition to raising rates, the Fed started to reduce the swollen balance sheet after nearly a decade of quantitative easing (buying bonds from the financial market). The Fed allows these bonds to either mature or sells them back into the financial markets.

This balance sheet tightening, coupled with higher rates, will put the financial systems under significant strain — falling asset prices and lower liquidity — and increase the costs of a recession. At this point, the Fed will likely reverse its monetary policy to rescue the economy and the financial markets, according to Lyn Alden.

Many macroeconomic researchers and commentators have concurred that interest rate hikes in the US and Europe will be short-lived.

As the central banks reverse their course and return to "money printing," bitcoin will get another chance to shine. Contrary to the common belief that bitcoin is an inflation hedge, it is a much better hedge against loose monetary and fiscal policies, as concluded by Brent Donnelly, the president of Spectra Markets.

Since hitting the mainstream, bitcoin has gone through two Fed cycles. It bottomed when the Fed turned dovish [(started increasing rate)] in early 2019, and it bottomed again when the Fed did QE in March 2020. Then, bitcoin topped when the Fed pivoted to a hawkish stance in November 2021.

Bitcoin strived during the 2010s when central banks kept the interest rates low and "printed money", thus slowly devaluing their currencies. If those times return, bitcoin will flourish because it is ultimately the best hedge against currency devaluation.

Crypto Meltdown

Enough of the macroeconomic discussion; let's now turn to the crypto world and the most prominent crypto event in years — the Terra-Luna ecosystem collapse.

On the 9th of May, TerraUSD, an algorithmic stablecoin pegged to the US dollar 1:1, started to lose its peg to the dollar. On the 11th of May, the stablecoin was trading around 16 cents. How could this have happened?

Stablecoins are the link between the fiat and cryptocurrency worlds. They are digital tokens that are tied to a currency or financial instruments. The two largest stablecoins — Tether and USD Coin — are tied to the US dollar. Tether and the Center Consortium, the companies behind these two stablecoins, promise to exchange them for $1 by holding reserves of US dollars or US bonds. In contrast, TerraUSD was algorithmically linked to another cryptocurrency native to Terra's blockchain —Luna.

Here is how it works. One TerraUSD is backed by $1 worth of Luna (it could be one Luna coin if its value is $1 or 0.01 Luna valued at $100). When demand for TerraUSD increases, pushing its value above $1, the algorithm creates additional TerraUSD coins while destroying the equal amount of Luna to bring the peg back to $1. It is done with the help of profit-seeking investors, who buy $1 worth of Lune and exchange it for TerraUSD. In essence, TerraUSD is backed by the supply of Luna, which regulates the supply of the former and absorbs fluctuations in demand.

And this is where the problem lies. The value of TerraUSD depends solely on the value of Luna. Suppose people want UST (a stablecoin or an attractive interest paid on TerraUSD deposited by some of the applications in the ecosystem). In that case, they will buy Luna, making its price appreciate. TerraUSD is now backed by a valuable Luna, which makes it worth $1. As Matt Levine from Bloomberg put it in his piece, the investors' confidence gives TerraUSD its peg to $1.

But what if investors lose their confidence and the peg goes below $1, say to 90 cents? Investors will rush to convert 90 cents worth of TerraUSD for $1 Luna, flooding the market with Luna coins. However, they won't be able to sell Luna for $1 as the confidence has failed and the market is oversupplied. Each subsequent investor will have to sell for an even lower price, which further increases the supply of Luna as the next investor converting TerraUSD to Luna creates more of the latter — a "death spiral."

By mid-May, Luna, which was in the top 10 most valuable cryptocurrencies, crashed to nearly zero — $0.0003035 on the 15th of May, according to CoinMarketCap data.

The Terra debacle was not out of the blue, however. The concerns about the algorithmic peg mechanism were acknowledged well in advance by some experts.

"A late implosion of [Luna] would be catastrophic for the space. The systemic risk would contagion through the entire industry and send us into a cold, bitter and long winter," said Galois Capital, a crypto hedge fund, in their 18th of March Tweet thread.

In ARK's 16th of May newsletter, Frank Dawninn pointed out that the price stability mechanism Terra employed only works during stable market conditions.

A broad-based sell-off decreased the demand for all crypto assets, including UST and Luna, enough so that the arbitrage necessary to stabilise the UST price became unattractive to investors.

The aftereffects of TerraUSD's de-pegging were not contained within the ecosystem. Bitcoin prices went into freefall as Luna Foundation Guard (LFG) — an organisation that supports the stablecoin — tried to protect the peg.

During the first quarter of 2022, LFG accumulated bitcoin to form a reserve asset to back TerraUSD. When the crisis struck, the LFG started loaning bitcoin to market-makers to buy back TerraUSD to restore the peg. According to some accounts, LFG sold most of its $3.5 billion bitcoin reserves by mid-May.

What can we learn from this? To compete with Bitcoin, alternative cryptocurrencies (altcoins) try to be innovative and offer something that Bitcoin lacks. However, this comes at a cost, https://www.alexanderborulev.com/blog/jfurjwn7f61sioj2cbuc58gdjmwlbhas I pointed out in one of my previous posts.

The" innovation" of the altcoins is a sacrifice of decentralisation, security and reliability to achieve greater functionality. Yet, the founders of altcoins do not mention these sacrifices in pitchbooks exposing investors to greater risk.

These trade-offs are rarely advertised to investors (and sometimes not understood by the founders), but rather are marketed as though they are pure technological improvements. And that advertising draws a lot of people in, especially when combined with VC-funded temporary economic incentives.

Eventually, some of the altcoin projects will fail, inflicting pain on investors. The UST and Luna crash has been the most prominent layer one blockchain crash in history so far — $28 billion that was locked in different decentralised finance applications evaporated, Frank Dawninn wrote in ARK's newsletter.

These failures will only strengthen Bitcoin as it is the only secure and decentralised monetary system built on decades of ideas and research. The Terra-Luna debacle could set a new period in crypto when only the best projects survive. Jack Tao, CEO of cryptocurrency exchange Phemex, said in the Cointelegraph interview on the 13th of May:

There will be much more scrutiny from now on, and investors will feel comfortable choosing to invest in only the largest cryptos such as Bitcoin, Ether and Solana.

Bitcoin For Retirement

I want to finish my post positively, so let's turn to a cheerful piece of news we've seen this quarter.

One of the top five asset management firms — Fidelity Investments — announced in late April that it would allow retirement savers to invest in bitcoin through their pension accounts later this year. Fidelity's clients will be able to diversify into bitcoin through the new workplace Digital Assets Account. Dave Gray, Fidelity's head of workplace retirement offerings and platforms, told Wall Street Journal that cryptocurrencies will shape how investors think about their portfolios.

Earlier this year, Fidelity Digital Assets published the "Bitcoin First" report outlining the differences between bitcoin and altcoin, the unique properties of the former and two different frameworks for thinking about investments in cryptocurrencies. The report also highlighted that:

Bitcoin should be considered an entry point for traditional allocators looking to gain exposure to digital assets.

The move by Fidelity highlights the growing interest from the traditional finance clients for bitcoin and other cryptocurrencies and the willingness of some financial institutions to embrace the new asset class.

However, as James Lavish pointed out in the interview with the "We Study Billionaires" Podcast, it is structurally challenging for the large financial institutions that control large sums of money (e.g. pensions funds or endowments) to move into the cryptocurrency market. They have strict investment mandates and a highly tedious process of adjusting them and setting up the operations.

When these financial institutions finally enter the crypto market, we can expect a massive inflow of funds into the space. The top five asset management firms* hold around $30 trillion in assets. A mere 1% allocation to the crypto industry is $300 billion - 30% of the global cryptocurrency market capitalisation as of the time of writing. Besides, who said these financial institutions would only allocate 1% of their holding?

What Next?

It looks like the new quarter started where the old one left off -- central banks are eyeing more aggressive interest rate hikes, many economic indicators are sounding recession alarms, and bitcoin hovers around the $20,000 mark.

Notes:

(*) I excluded USB Group because a large proportion of AUM comprises wealth management

Disclaimer: This blog post is not intended as financial advice. It is provided for information and entertainment purposes only. Do your own research.